Pay mortgage twice a month calculator

How Bi-Weekly Payments Work. Or whenever you get a bonus or tax refund you could put it toward your mortgage to lower your principal balance.

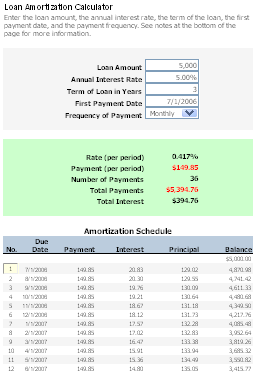

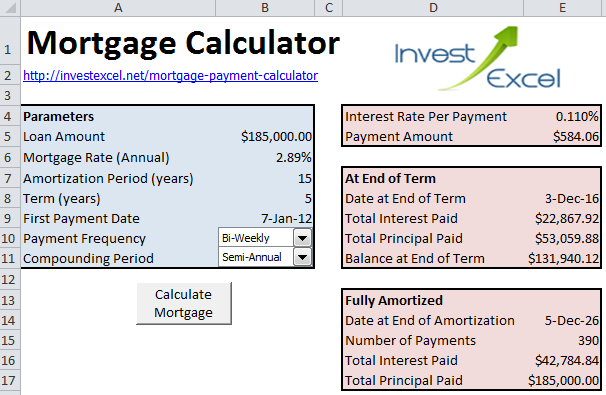

Free Loan Amortization Calculator For Car And Mortgage

Use this free online calculator to see how much you will need to pay each month to pay your loan off in a set amount of time.

. If you want to make a lump sum extra payment of. Our online services is trustworthy and it cares about your learning and your degree. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments.

To determine how much property tax you pay each month lenders. The loan is secured on the borrowers property through a process. Homeowners with a 15-year.

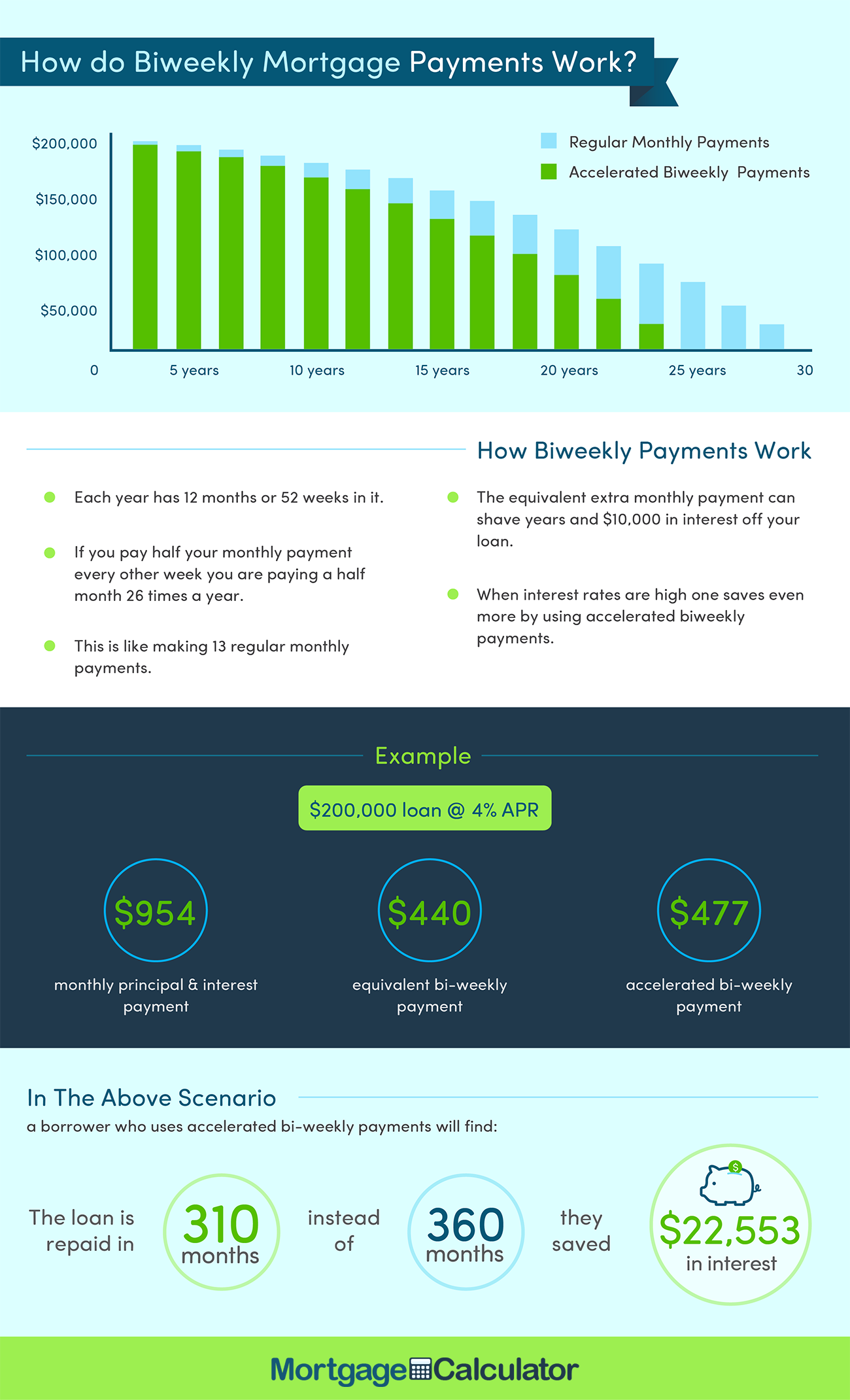

This means an extra payment is not made. A biweekly mortgage payment schedule makes a payment on your mortgage every two weeks instead of once a month. You can also pay your mortgage every 2 weeks as opposed to once a month which will help you pay off an extra month every year.

If their assets cannot cover the mortgage they will be forced to move out of the home. Pay 2 times a year. Paying Taxes With a Mortgage.

Pay each week generally on the same day each pay period. Your Payment Isnt Applied as You Pay. Make sure you look for mortgage scams and check with your lender to make sure it supports biweekly payments and credits you appropriately.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Put 20 down or as much as you can for your down payment. The concept of a twice-monthly payment is a bit misleading.

Also consider rounding up your payments to pay your mortgage faster. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. The amount you pay each month for your mortgage homeowners insurance and HOA fees.

We used the calculator on top the determine the results. By paying 1000 twice a month or 24 times per year you would make a total of 24000 in payments the same as you would if you paid monthly. Choose a longer-term mortgage like a 30-year rather than a 15-year loan.

Pay on specified dates twice a month usually on the fifteenth and thirtieth. Taking a reverse mortgage drains away equity from your home. This service is similar to paying a tutor to help improve your skills.

Lenders often roll property taxes into borrowers monthly mortgage bills. That leaves plenty of room in your budget to achieve other goals like saving for retirement or putting money aside for your kids college fund. The typical mortgage asks for one payment per month which equals 12 payments per year.

The biweekly payment just forces an extra payment at the end of each year. But when you pay twice per month you might be able to decrease the amount of debt that accrues interest each month by paying. Improve your credit score.

Pay every other week generally on the same day each pay period. A quick note here. Your mortgage servicer holds the payment and applies it once a full monthly payment is received.

Pay 4 times a year. In some cases a surviving heir can cover the reverse mortgage payment by taking a new loan on the house to pay off the mortgage. Lenders mortgage insurance LMI can be expensive.

With a significantly lower rate you could potentially save twice over your initial mortgage. Instead of paying one monthly payment they pay half the payment twice a month. Both the principal and interest amounts decrease over time whether you make payments on the 1st 15th or a date in between.

Before doing anything else use the above extra mortgage payment calculator and see how much you may save in the long run. So youd pay 360 payments over a 30-year period to zero out your mortgage balance. While 20 percent is thought of as the standard down.

Heirs must pay the reverse mortgage to keep the home. You can use your current lender to switch to biweekly payments or create a schedule yourself. A bi-monthly mortgage does not have the same results as a bi-weekly one because the homeowner pays half of the monthly mortgage twice instead of every two weeks.

One popular way that some homeowners other borrowers pay down their principal more quickly is to make biweekly payments. If the 1st or 15th falls on Saturday or Sunday payday is the Friday before. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments.

Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows. Even though the payment is withdrawn from your bank account twice a month it isnt applied to your mortgage that way. Say your mortgage is 2000 per month.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. For instance if youre planning to remortgage into a 5 fixed-rate loan it. Hence you should be sure of the fact that our online essay help cannot harm your academic life.

If you get paid every other week multiply your take-home amount by 26 for the number of checks you get each year and then divide by 12 to get your monthly take-home pay. For example if you plan to pay an extra 100 per month you shouldnt have to change anything with the default settings. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance.

In other words if you pay 2000 each month in debt services and you make 4000 each month your ratio is 50half of your monthly income is used to pay the debt. Try to avoid PMI private mortgage insurance if you can. How much to put down.

Pay on a specified day once a month. While private lenders who offer conventional loans are usually not required to do that the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments. If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator.

Lower interest rates mean youre paying less each month and over the life of the loan. This payment should be no more than 25 of your monthly take-home pay. There is no best day of the month to pay your mortgage.

30-Year Fixed Mortgage Principal Loan Amount. Using our mortgage rate calculator with PMI taxes and insurance. If they select to receive their pay twice a month they will receive semi-monthly pay on the 15th of each month.

Other Ways to Save Money on Your Loan. Bi-weekly is not the same as twice a month. If you get paid twice a month add the take-home amount of your two checks together and enter that amount.

With course help online you pay for academic writing help and we give you a legal service. Use this mortgage calculator to estimate how much house you can afford. Read More.

There is a difference between saving only a single months interest instead of seven years interest.

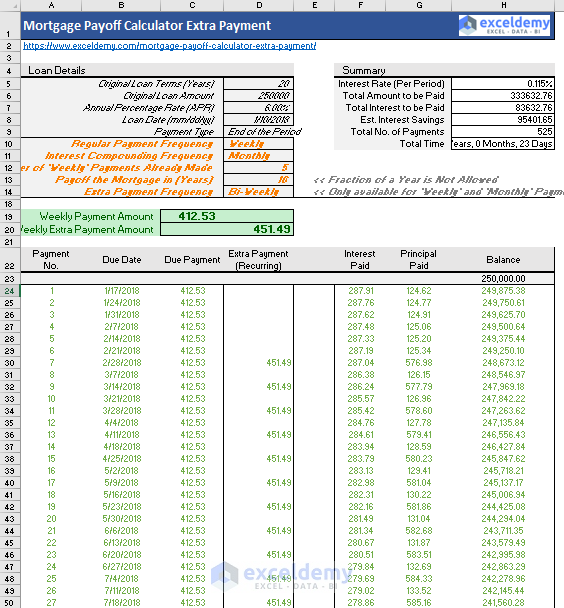

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Biweekly Mortgage Calculator How Much Will You Save

Mortgage Payment Calculator Mcap

Biweekly Mortgage Calculator How Much Will You Save

Calculator For Mortgage Shop 56 Off Www Wtashows Com

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

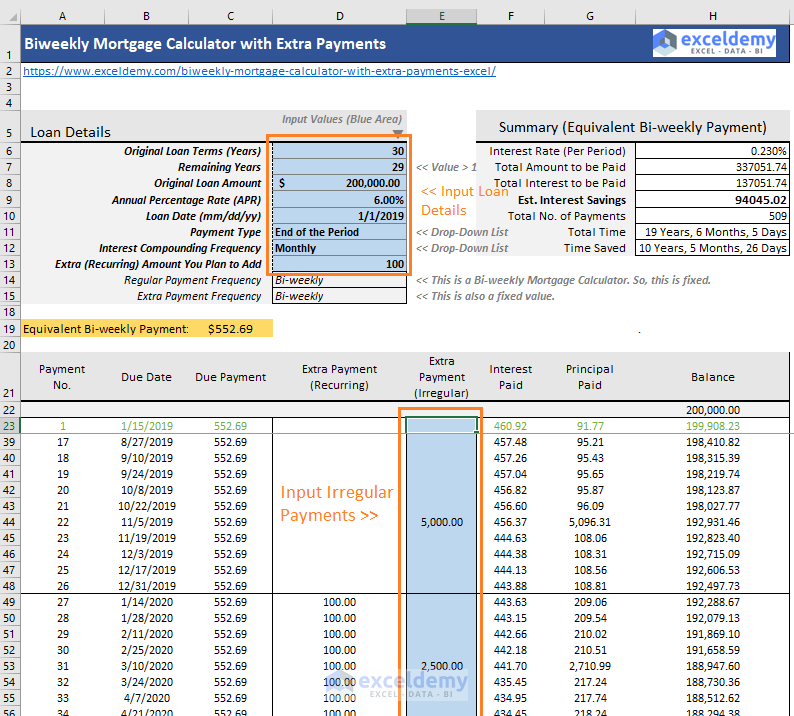

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

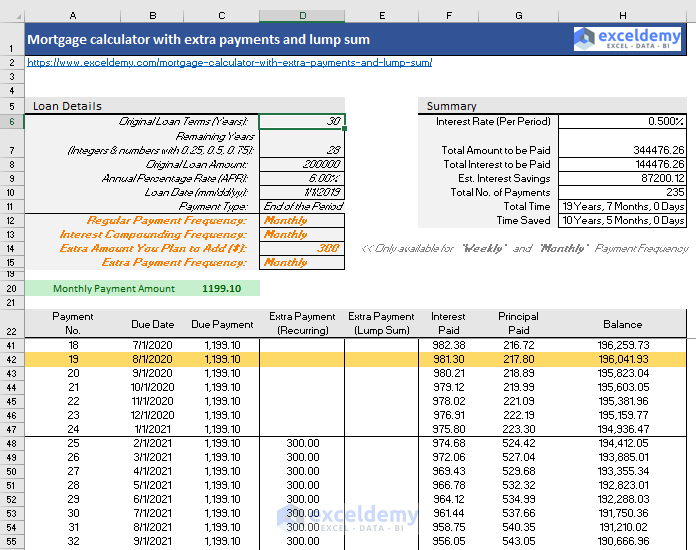

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

How To Calculate Mortgage Payments In Excel

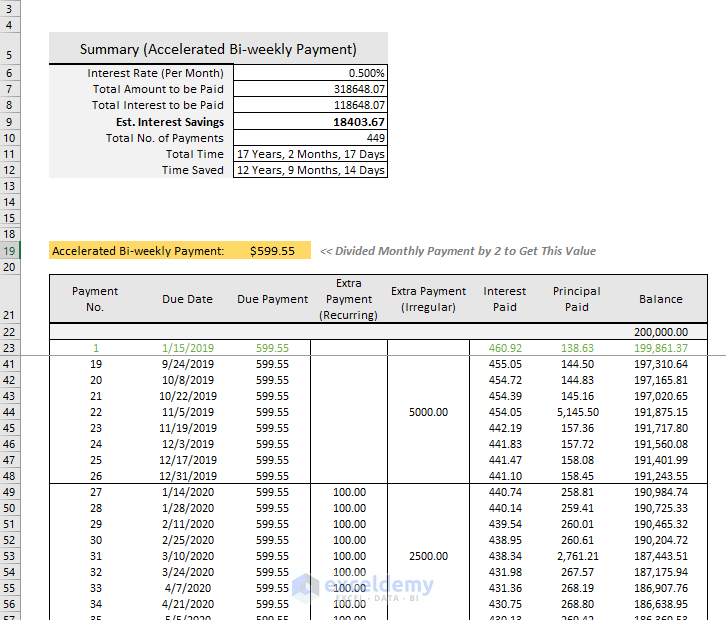

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

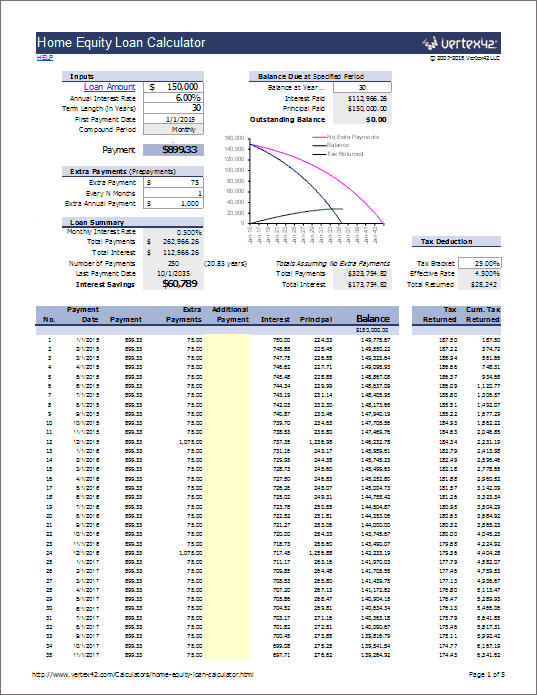

Home Equity Calculator Free Home Equity Loan Calculator For Excel

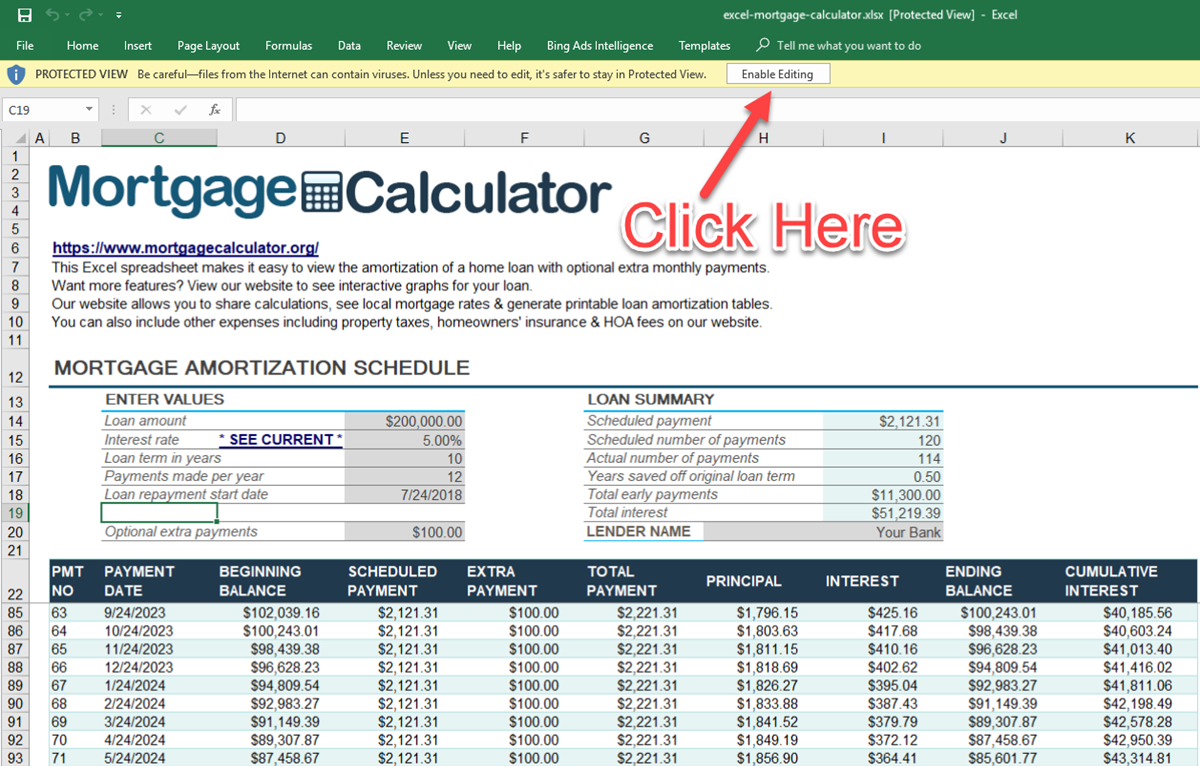

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

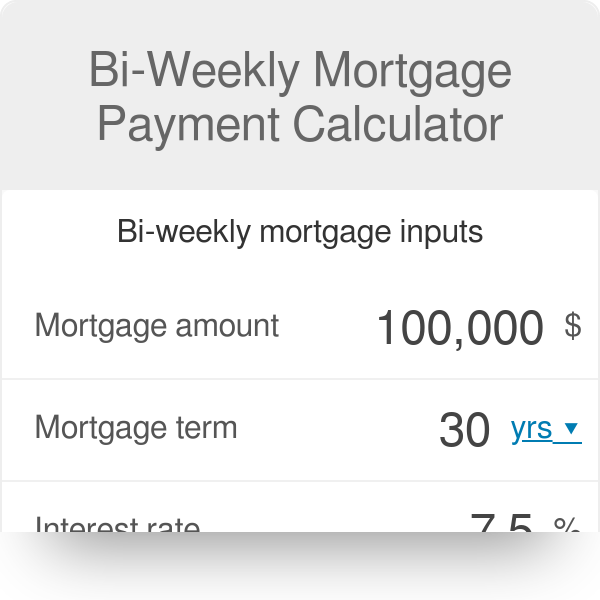

Biweekly Mortgage Calculator

Bi Weekly Mortgage Payment Calculator

Extra Payment Mortgage Calculator For Excel

Mortgage Payment Calculator With Amortization Schedule